News & Insights / The investments you don’t see…

The investments you don’t see…

- September 6, 2023

- by Mesh

There has been recent global interest in the private markets or alternative finance (AltFi) space. Definitions abound as to what fits into this space, but for the sake of simplicity let’s say that private market investments are any investment propositions that live outside of the liquid and well-regulated public markets, such as the stock, bond, or derivative exchanges, these are financial assets which have limited public venues through which to sell.

A perfect example of this is private corporate debt. Credit-worthy private businesses which wish to borrow money to finance growth have traditionally had limited options available to them. Banks and private equity companies are the two most obvious options (outside of an IPO), but aside from those, they have limited ways to reach a broader market, which includes investors from outside of the financial community.

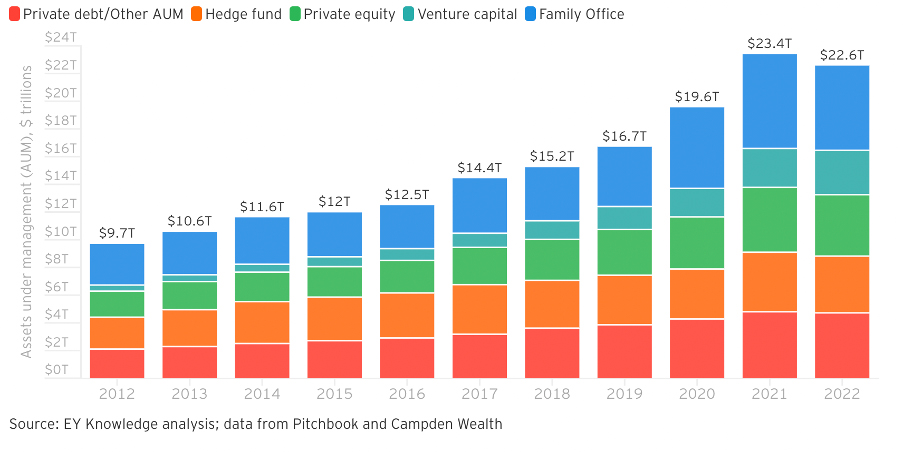

Why? you may ask. There are many answers, but they basically boil down to complexity, risk, and regulation. These sorts of deals have generally been conducted out-of-sight of the public eye, and according to well-worn processes, hardened over decades, weighted down by process and policy. How big is this mostly hidden market? A recent report by EY gives us an estimate of $22.6 trillion as of 2022, and growing rapidly:

Now let’s talk about who is out there dying to get their hands on a piece of these deals. There are of course businesses with healthy treasuries, always looking for low risk/high yield investments. And then there is the growing retail investor segment, along with registered investment advisors, especially those financially sophisticated enough to be able to evaluate the quality of an alternative finance offering.

But more recently, a third market has emerged.

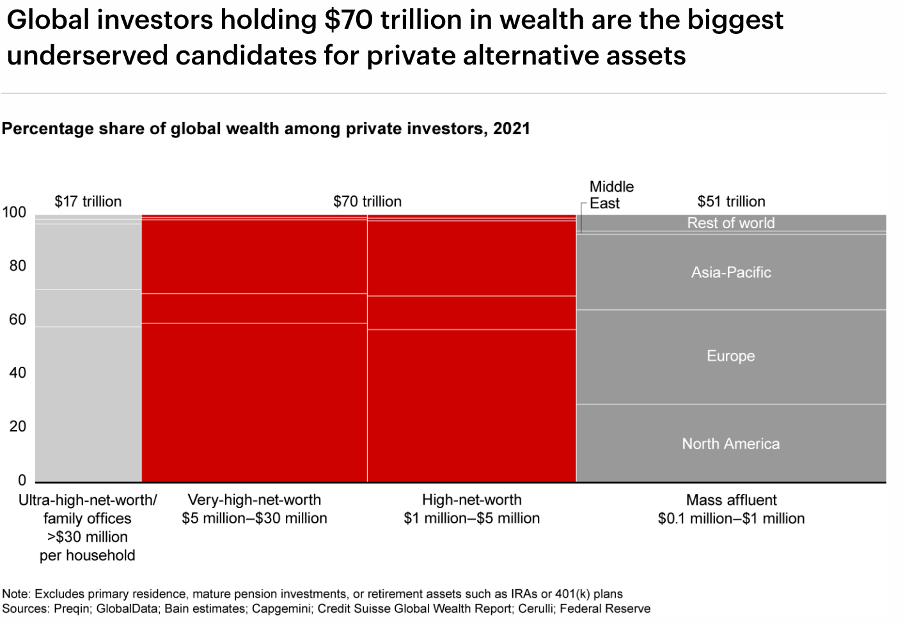

And that is ultra-wealthy individuals, disillusioned with stagnant equity markets, the blandness of traditional debt options and the risk of emerging markets. For these people who represent $70 trillion (!) in household wealth, quality private assets are a new asset class of great interest.

Consider this startling graphic from a recent Bain research report called “Private Markets Desperately Need New Market Infrastructure” :

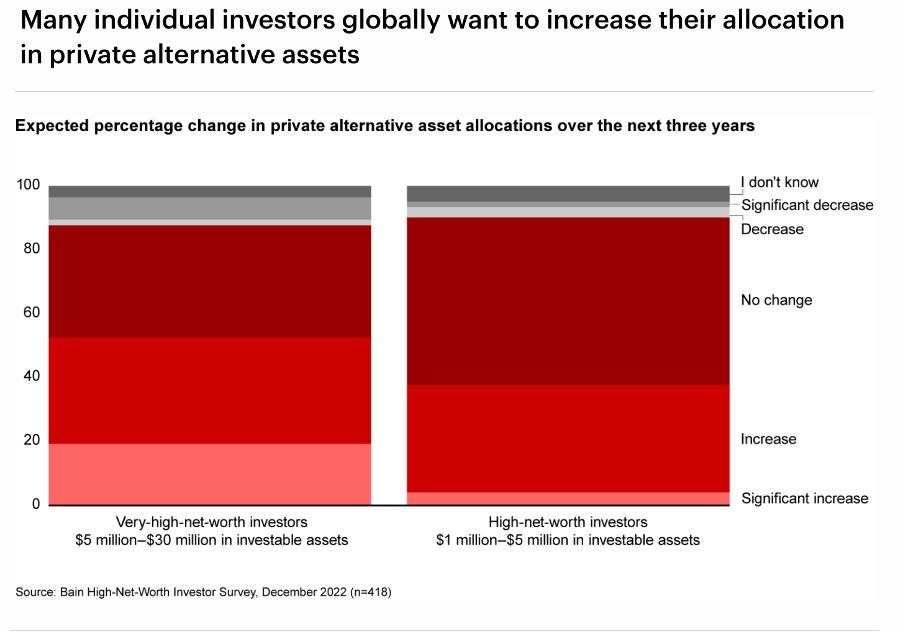

There is one last graphic we want to leave you to ponder.

A new class of investor has arrived in private markets. HNWI and UHNW Individuals are now looking beyond their traditional investment horizons. Over 50% of the ultra-rich and nearly 45% of the merely very rich are looking to invest in private capital – exactly what we offer on our platform.

Tags

AI AltFi Blockchain Capital Markets Capital Markets Capital Markets of the Future Investing Mesh Open to all Smart Assets Capital Markets of the Future Commodity Markets Cryptomarkets Crypto Markets Decentralisation DeFi DeFi Mesh Cryptomarkets Digital Bond ETN Financial Markets FinTech FSP Global Markets Gold Investing Investment Mesh Open to all Preference Shares Regulation Secondary Market Smart Assets Stablecoin Tokenisation TradFi Webinar

- AltFi, Blockchain, Capital Markets, DeFi, Financial Markets, Investing, Mesh, Private Equity, TradFi

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515