- Issuers

- Investors

- Services

Features and tools

Services and rules

Features and tools

Services and rules

- Company

- News & Insights

About Us

About Us

The future of investing, today.

The average traditional financial asset issuance can involve as many as 40 intermediaries, with this global financial intermediary sector extracting over $200 billion of value from the market every year.

But this is changing – rapidly. Technological advancements in capital markets are opening up new opportunities for issuers and investors.

The old, centralised models of investment and issuance are being replaced by a new, more secure, more efficient, open financial system, unbound by geographical boundaries or traditional layers and structures.

At Mesh, we’ve created an open capital markets ecosystem where a private company can access capital without knocking on the doors of institutional investors. And where every investor can get direct access to a range of interesting alternative and private capital investment opportunities through a secure, simple, and flexible capital markets ecosystem.

Mesh sits at the forefront of the next generation of capital markets

Mesh is a digital ecosystem for raising capital and trading capital markets assets.

Founded on the belief that capital markets should be easy to access, simple to use and transparent, Mesh has built the underlying infrastructure for the future of finance.

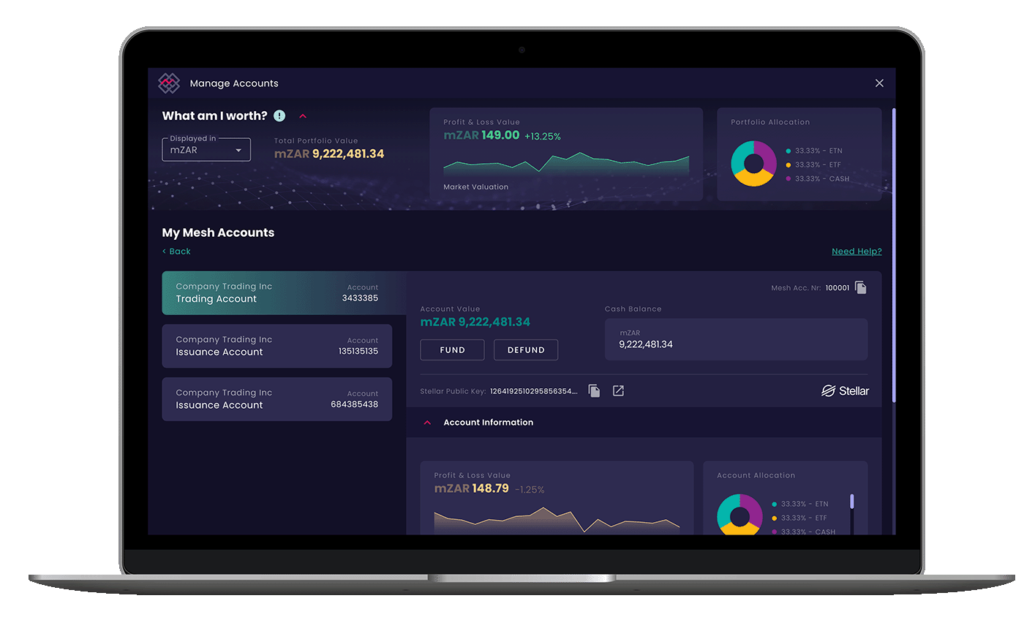

Through its streamlined, end-to-end global capital markets infrastructure, Mesh provides standardised tools and simplified workflows for complex market mechanisms and multi-geography regulatory requirements.

Using the best of leading edge blockchain technology, Mesh has removed the need for many existing market intermediaries, removed the traditional barriers to entry, eliminated excessive participation costs, and made capital raising and investing much more efficient for all market participants.

Mesh provides a multi-sided financial markets infrastructure within its ecosystem to connect issuers and investors directly to each other in a trusted way, facilitating easy interaction and secure, compliant and efficient trade.

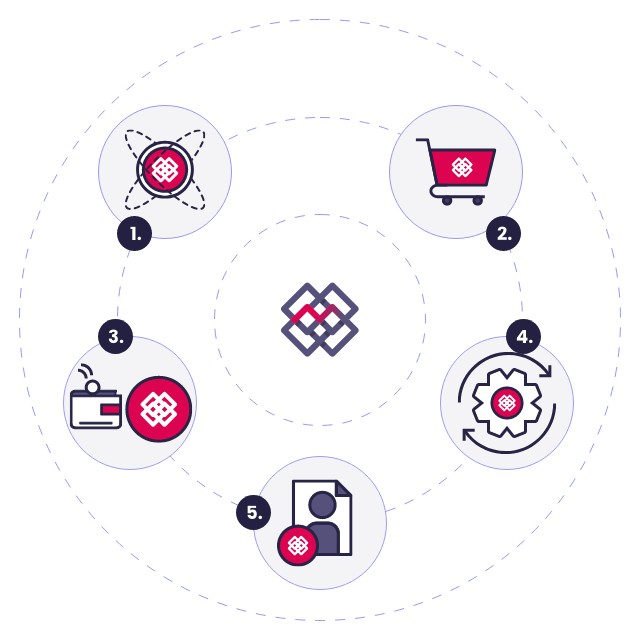

Mesh has compressed the 5 main functions of the capital markets into one elegant flow:

- Asset Origination, Issuance, and Tokenisation.

- Primary and Secondary Market Mechanisms for the Distribution and Trade of all Assets.

- Full and Final Settlement Mechanisms – both Cash and Security token.

- Lifecycle Management and Asset Servicing – such as coupon calculations, payment, and maturity management.

- Ownership Verification through the platform’s Asset Registry.

The one-stop shop for New Capital

Mesh is the ideal solution for companies looking to issue regulatory-compliant, efficient, high-yielding and trusted assets.

Mesh’s unique capital markets ecosystem powers the issuance, distribution and instant settlement of smart financial assets in the alternative finance (AltFi) or private capital sectors. These are unique assets, not available anywhere else, issued directly on Mesh by forward thinking businesses in high growth industries.

Smart Assets with Mesh Oracle at the Core

Smart Assets are unique to the Mesh ecosystem. These are digitally native financial instruments, originated, issued, tokenised and traded on Mesh.

The Mesh Oracle which underpins the platform’s innovative Instrument Builder and Issuance Hub creates the foundation for instrument innovation, the issuance of non-traditional, unique, complex AltFi and private capital assets. This cross-asset credit creation mechanism is designed for the next generation of capital markets.

Our Story

The Mesh team has extensive experience and expertise in the platforms, infrastructure, instruments, and operations that underpin the traditional financial and capital markets.

The team spent four years reimagining and building a new financial markets infrastructure and ecosystem that compresses existing capital markets complexity into an elegant flow, solving for the major inefficiencies, inequalities, and waste in the current system.

The result is Mesh: an end-to-end open capital markets ecosystem that allows market participants to issue, tokenise, trade, settle, verify ownership and lifecycle manage multiple classes of digital securities at a fraction of the time and cost of the traditional capital markets.

Why Choose Mesh?

Mesh makes asset issuance easy for institutions or companies.

Mesh users can issue and tokenise any traditional financial asset, alternative assets or non-vanilla instruments directly on the blockchain. This provides irrefutable proof of ownership, together with secure, immutable transfer of ownership.

Mesh makes it easier and more efficient for issuers to raise capital and for investors to invest, trade and manage asset holdings in the Capital Markets.