Why you should use Mesh to digitise your business

Mesh will help you manage your existing client relationships and access new ones, quickly and transparently.

- Take your business digital.

- Gain market reach and visibility .

- Increase speed to market.

- Reduce your costs.

- Access a global network of investors.

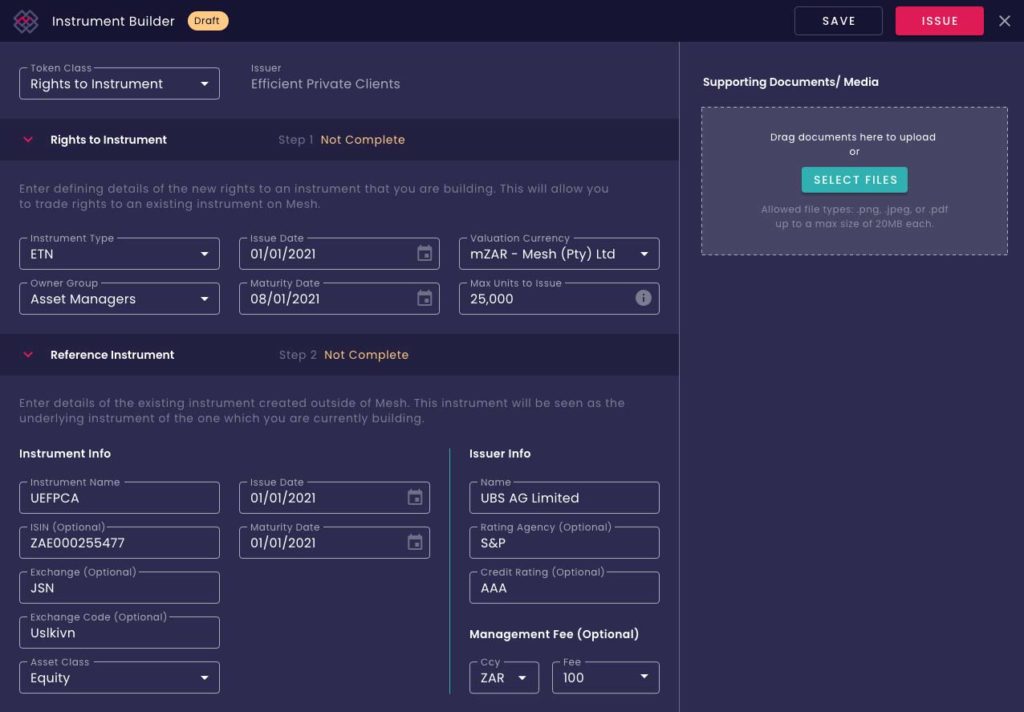

With Mesh you can issue any type of financial instrument on behalf of your clients, and get immediate access to a marketing and distribution channel for that asset, easily and transparently.

Market Reach & Visibility

- Mesh can be a real-time digital channel for your business.

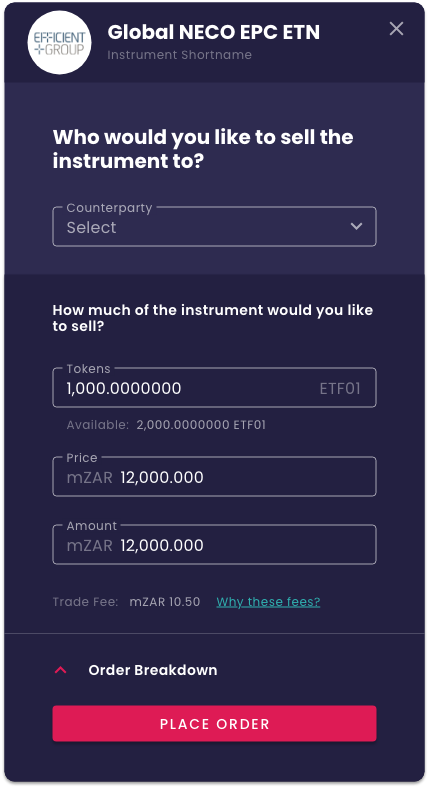

- It allows you to manage existing client relationships, through the Mesh Marketplace.

- It lets you reach a wider network, and find new clients, not previously accessible through traditional capital markets.

- With Mesh you are able to issue any financial instrument on behalf of your clients, easily and transparently.

Digitisation

- Mesh gives you an easy and transparent way to issue any class of financial instrument on behalf of your clients.

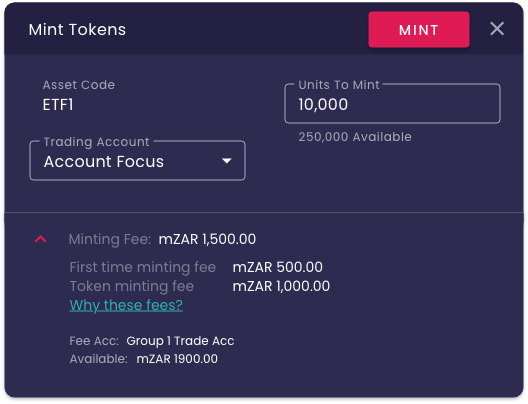

- Mesh delivers market-beating speed to market for arranging and issuing assets through primary and secondary market mechanisms: Mesh reduces a traditionally two week process, down to five minutes.

- Mesh will give you immediate access to a global digital channel for the marketing, distribution and sales of any financial instrument, on behalf of multiple clients.

So, what are you waiting for?

- Mesh minimises and simplifies complex processes

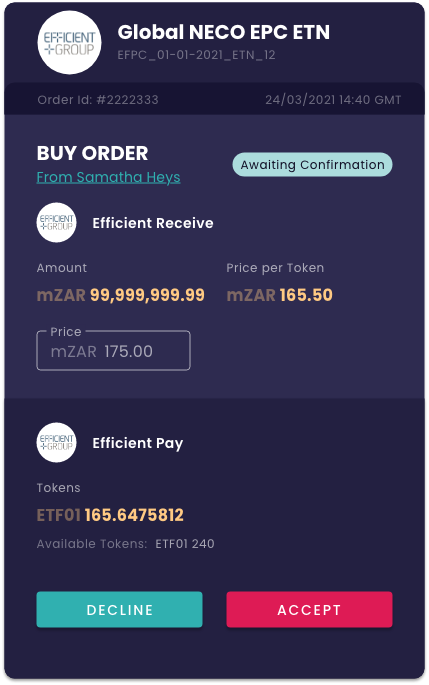

- Secures asset ownership: maintaining a single version of the truth

- Allows you to actively manage cashflows and corporate actions