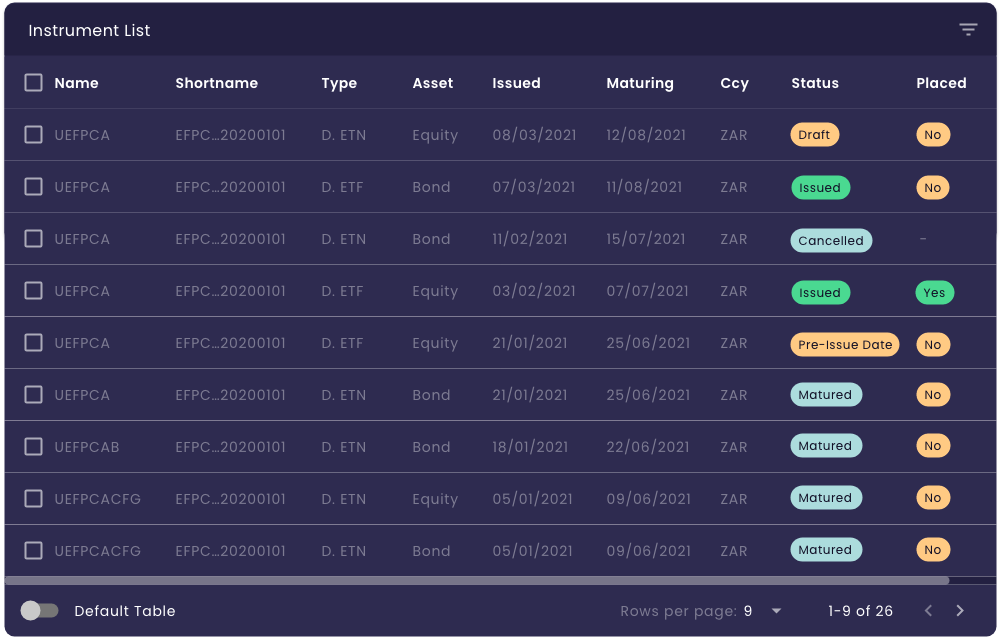

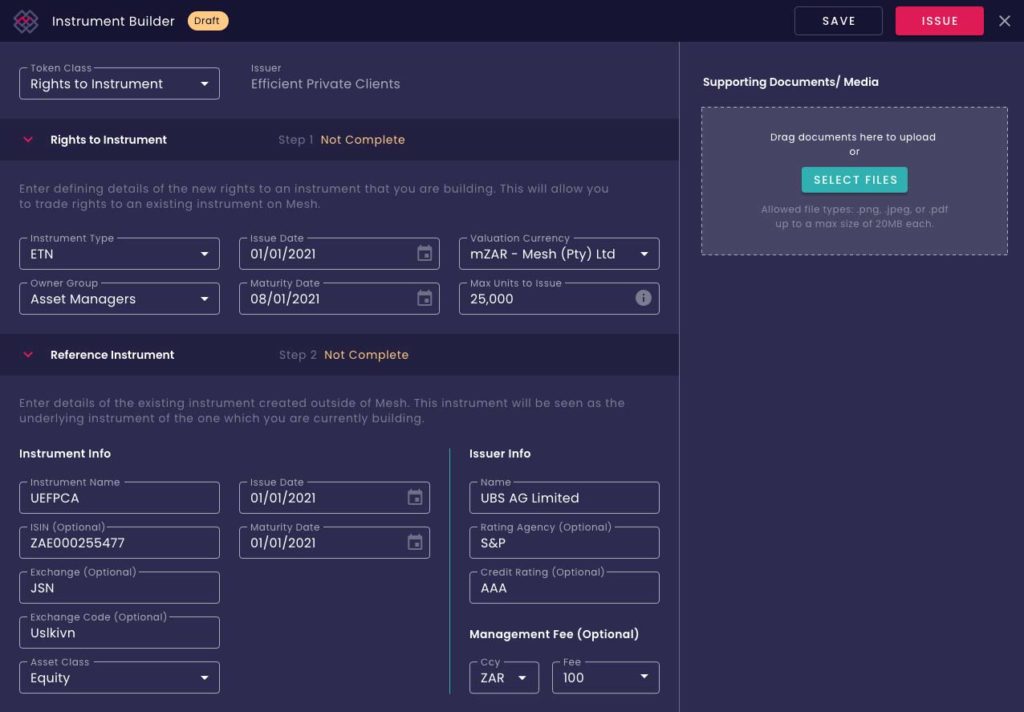

The Mesh Issuer Hub is a smart way to raise capital or structure your balance sheet.

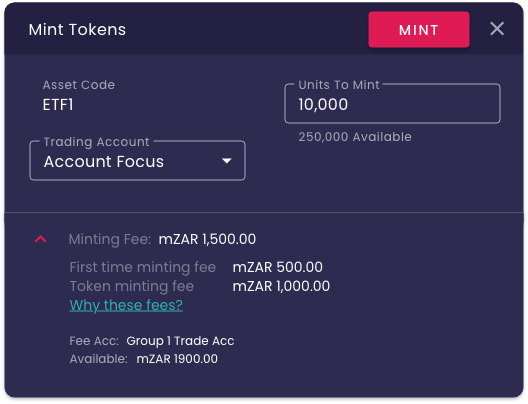

Mesh gives business owners a simple and guided process to define any financial instrument and issue it to market within minutes. This includes standardised legal agreements and streamlined workflows that substantially lower issuance costs.