Mesh offers businesses smart solutions for raising capital.

Mesh gives companies looking to raise capital or structure their balance sheets the ability to issue equity, debt or other financial instruments, easily and directly to a community of professional and retail investors.

Want to raise capital on Mesh?

Want to raise capital on Mesh?

What you get with Mesh.

Mesh works with you to simplify and streamline the process of issuing the right asset class - debt, equity or other structures - so you can raise capital directly from your chosen network of investors.

Mesh enables you to:

Mesh enables you to:

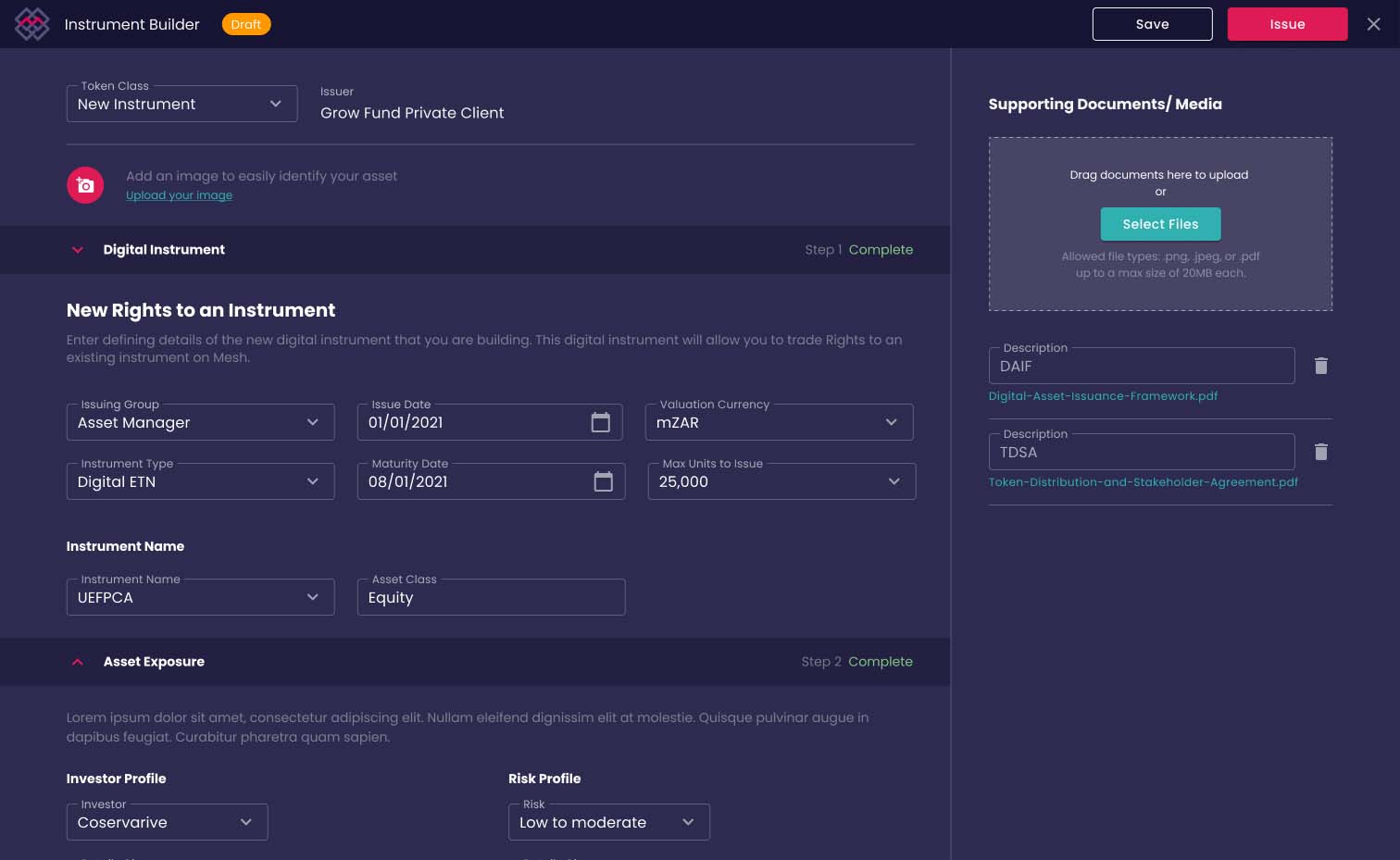

Issue a Smart Asset using Mesh’s dynamic Issuer Hub.

Deliver its legal structure and term sheet.

It will be ready to react to resets, redemptions, coupons and calculations.

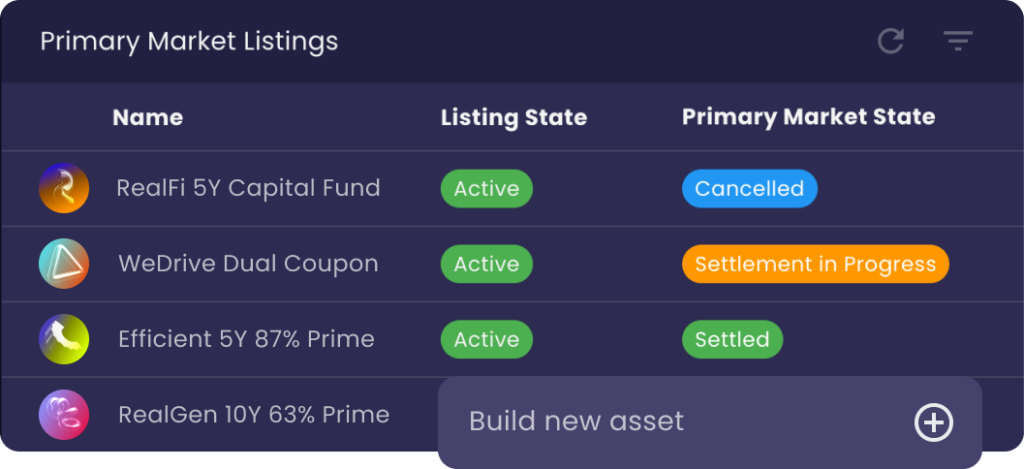

Place it in the Primary Market.

Issue a Smart Asset using Mesh’s dynamic Issuer Hub.

Release it to a Secondary Market with built in liquidity mechanisms.

Maintain direct control of investor relations through Mesh’s digital share register.

Why choose Mesh to raise capital?

Raise Capital Without the Hassle

Whether you’re issuing a financial asset for the first time or you're a seasoned player, Mesh is designed to make the process as easy as possible for you. Our simple, guided process and standardised legal agreements will streamline your workflows and lower your costs.

Transparent, Secure and Trustworthy Process

Know exactly what’s happening, every step of the way. Mesh provides complete transparency, offering you real-time updates and visibility across the entire issuance process. From compliance to investor relations, we ensure that you stay in control without the guesswork.

Innovation at Your Fingertips

Built on the latest technology, Mesh allows you to issue digital financial assets with unparalleled speed and security. All asset classes, from debt, equities, fund structures, commodities and more are available to match regulatory requirements and your ideal target segment. And you can manage your asset directly across its full lifecycle.

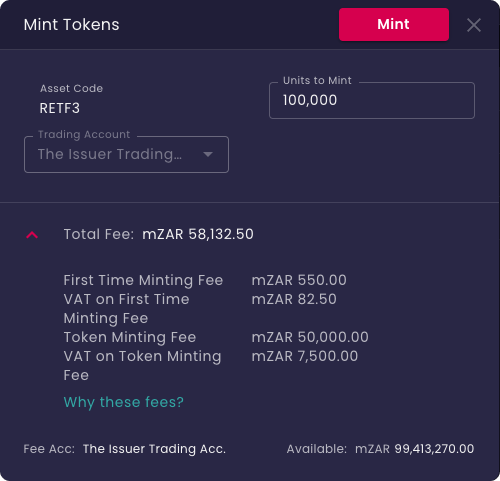

No-Nonsense Issuance

Issuing well-structured Smart Assets should not be complicated. With Mesh you get everything you need in one place—no jargon, no unnecessary barriers to entry, and no hidden fees. We’ve designed the platform to make your experience simple, efficient, and frictionless.

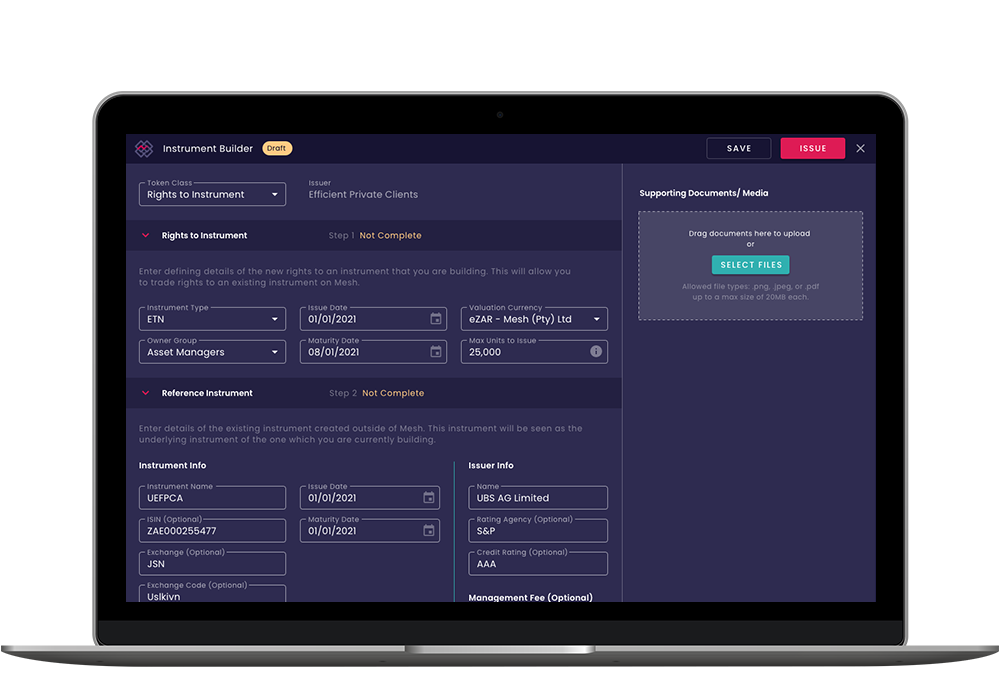

Mesh’s one of a kind Smart Asset Issuance Hub

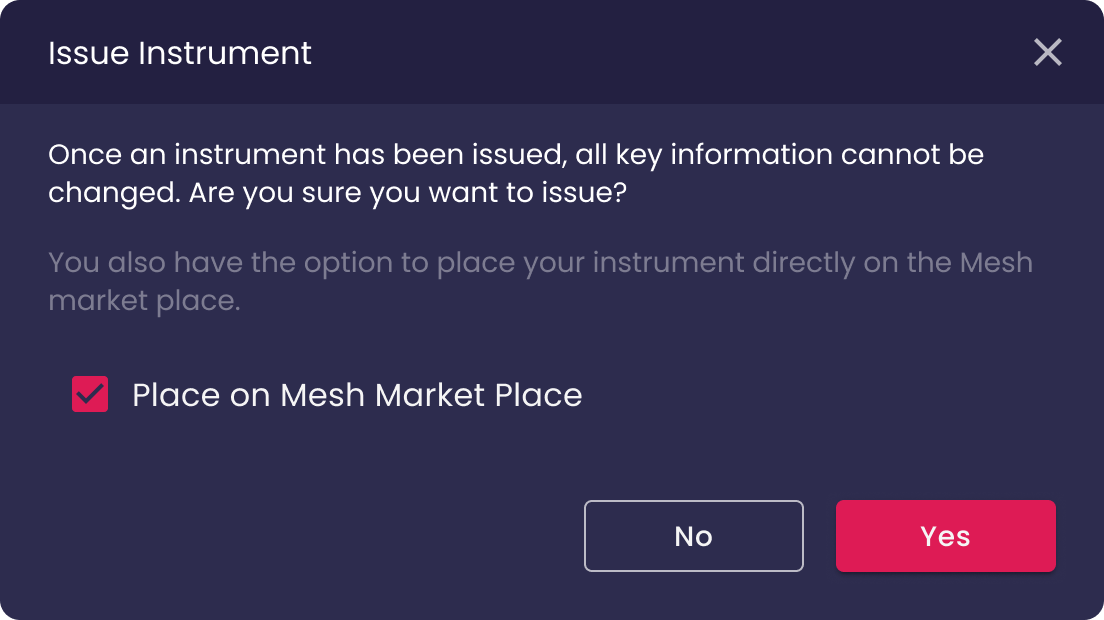

Mesh allows you to issue a fully compliant Smart Asset, delivering its legal structure and term sheet as a public offering or a private placement. Your asset will be instantly ready to react to resets, redemptions, coupons and calculations.

You can offer a Primary Market issuance, making it immediately discoverable to the right mix of investors, from Institutional to Retail.

You can also immediately release it to a Secondary Market with built-in liquidity mechanisms.

All through your asset’s lifecycle, you maintain direct and real-time control of corporate events and investor relations, using the Mesh Issuer Hub’s digital share register.

Financial Institutions

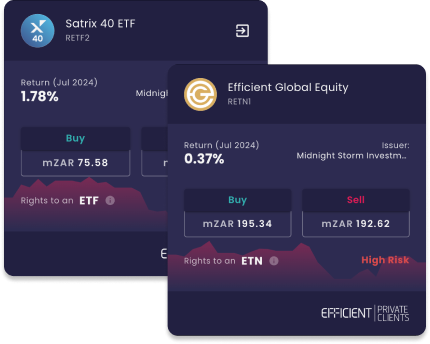

Get your own Mesh Space

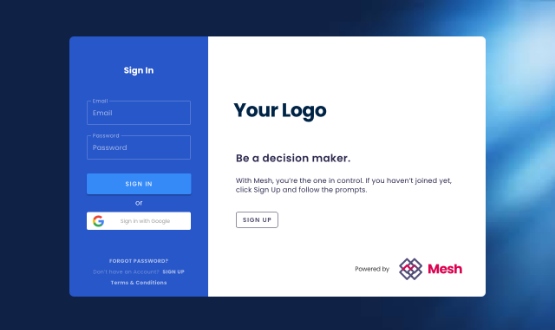

Our Mesh Spaces solution is designed to give financial institutions access to a co-branded, curated version of Mesh’s digital asset marketplace.

Need to raise capital for your business?

The capital markets today are slow, expensive, exclusive and inefficient.

Mesh makes it easier and simpler to raise capital directly from your community of investors - no unnecessary barriers.

At Mesh, we believe capital markets should be easy to access, simple to use and transparent.

Are you ready to raise capital on Mesh?

Are you ready to raise capital on Mesh?

What our customers are saying.

As a Financial Broker, I rely heavily on platforms that offer both reliability and cutting-edge tools. Mesh.trade has exceeded my expectations on every front. The seamless user interface, combined with their robust analytics, allows me to make informed decisions quickly and efficiently. Their commitment to security and customer support is unparalleled, giving me the confidence to trade with peace of mind. Mesh.trade is not just a platform; it's a vital partner in my trading success.

As a Financial Broker, I rely heavily on platforms that offer both reliability and cutting-edge tools. Mesh.trade has exceeded my expectations on every front. The seamless user interface, combined with their robust analytics, allows me to make informed decisions quickly and efficiently. Their commitment to security and customer support is unparalleled, giving me the confidence to trade with peace of mind. Mesh.trade is not just a platform; it's a vital partner in my trading success.

As a Financial Broker, I rely heavily on platforms that offer both reliability and cutting-edge tools. Mesh.trade has exceeded my expectations on every front. The seamless user interface, combined with their robust analytics, allows me to make informed decisions quickly and efficiently. Their commitment to security and customer support is unparalleled, giving me the confidence to trade with peace of mind. Mesh.trade is not just a platform; it's a vital partner in my trading success.

Is your business ready to raise capital on Mesh?

Read our checklist on what you need to have in place to make sure your business is ready to raise capital on Mesh.

Are You Ready to Raise Capital on Mesh?

Why Smart Assets Are Essential For Building The Finance 3.0 World

What is a Smart Asset?

What is Finance 3.0?

What investors want

Breaking Barriers, Building Bridges: How we’re redefining access to capital