The subscription window is now closed.

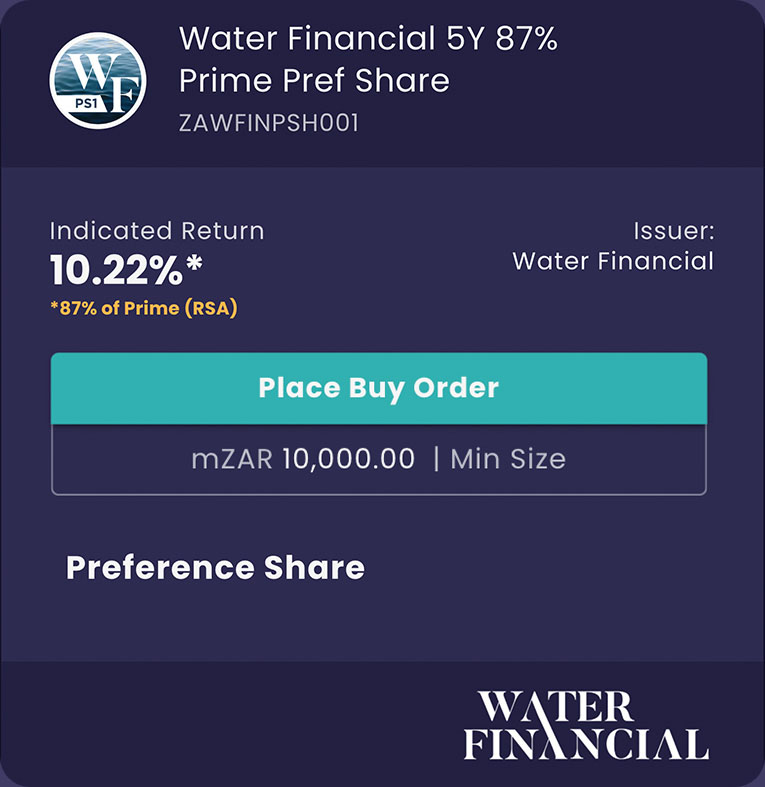

A limited number of Preference Shares have been made available to the public in this issuance.

An investment in Water Financial 5Y 87% of Prime Preference Shares can be tax efficient under certain circumstances.

Subscription window is only open till 30 August 2024.

Minimum investment is: R10,000 (or 10 shares @ R1,000 each)

View Asset to place your buy order now

Longer lifespans force us to rethink how we fund retirement. Many retirees’ incomes can’t keep up with the increasing cost of living.

Water Financial offers homeowners over the age of 70 the ability to unlock the equity in their homes, without the need to sell.

Water Financial (registered as Dihydro Finance Limited) aims to raise R 30,000,000 by providing investors with the opportunity to participate in the Company’s “A” Preference Shares.

This raise is the first of a series of capital raises targeted by Water Financial to fund the growing lending needs of the company, to serve their rapidly expanding client base.

By investing in Water Financial, you will be supporting a model that ensures elderly homeowners maintain ownership of their homes, receive necessary funds either as a lump sum or regular payments, and enjoy favourable terms tailored to their needs.

Your investment will help us provide maximum financial benefit to our clients with minimal disruption to their lives.

Key Investment Considerations

Amount to be raised:

R 30 mil

Dividend rate p/a:

10.225%

87% of Prime Rate

Dividends paid to preference shareholders will be post Dividend Withholding Tax payable by Water Financial.

Term:

5 Years

With first eligible call day starting 3 years and 1 day

Dividend Frequency:

Monthly

Minimum Subscription:

R10,000

Water Financial Company Background

Water Financial was founded in 2010 with the goal of empowering retired homeowners by unlocking the capital tied up in their properties.

Our mission is to offer innovative and ethical financial solutions that provide retirees with the financial flexibility to meet escalating costs that they need without sacrificing their most valuable asset.

We launched the Freedom Finance product in 2021 and hold more than R100 million of loan securities.

Chris Loker

Martin Goodman

Mike Freedman

Alec Erwin

Gidon Novick

Water Financial’s Business Model

Water Financial’s Freedom Finance offers pensioners access to a percentage of their home’s equity while retaining full ownership.

Water Financial values each property and uses an algorithm of 6 borrower and asset variables to determine a permissible Loan to Value, (portfolio is around 25%), registers a bond and holds Title Deeds, whereafter it disburses the loans monthly over a 60-month period.

At the end of the loan period the property is valued again, and a new offer made. Loans are settled on death, sale or moving. The loan needs to be settled before any transfer of ownership can take place. Only primary residential homes in urban or retirement nodes are currently considered, in order to manage and mitigate risk.

Applications are made online, and a quote supplied within hours (after valuation). If the borrower choses to proceed, the loan documentation is prepared and once signed handed over to one of a panel of conveyancing attorneys.

Once the bond is registered the monthly disbursements commence.

Why Private Credit?

Recent growth in private credit has been fuelled both globally and locally by institutional reticence to lend. Inherent structural inefficiencies within the banking system were exacerbated by the credit crunch and consequent regulatory changes, requiring higher capital provisions plus a focus on matching assets and liabilities, which has led to banks being unwilling to diverge from vanilla or standard offerings.

This has limited loan book growth and put pressure on banks to focus on shorter term, more expensive loans to fewer borrowers. This in turn has led to slower turnaround times, unpredictable credit decisions and higher pricing.

For Investors, a plus-inflation, highly secured, unleveraged and interest rate correlated return which is in turn uncorrelated with fixed income or equity markets, reduces the average investor’s portfolio volatility and enhances returns. This is a golden thread within modern portfolio theory, particularly when the underlying security, residential property, is the world’s largest.

In addition it unlocks dormant assets, catalyses the local economy by introducing liquidity and has a major social impact for those retirees.

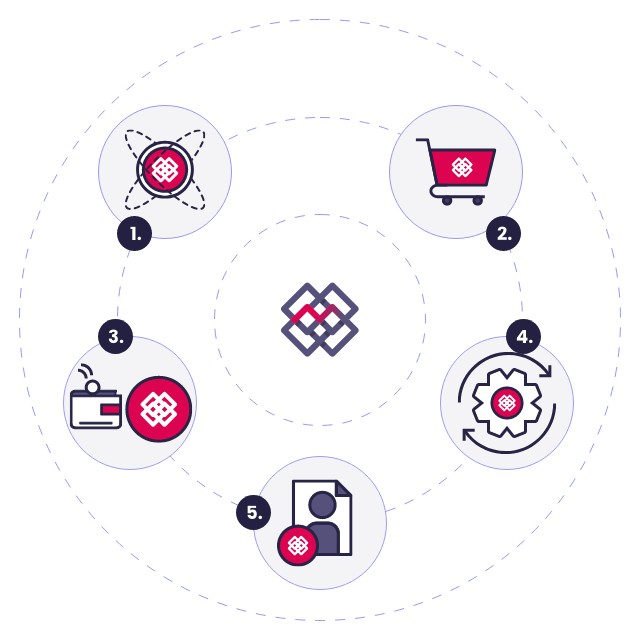

Tokenised Preference Shares on Mesh.trade

Tokenised preference shares are the same as a traditional preference shares, except that they are traded in the form of digital tokens that are issued natively on the blockchain.

At Mesh we call this a “Smart Asset“, a unique digital asset, issued, traded and lifecycle managed, end-to-end, within the Mesh ecosystem.

The issuance of these preference shares on the blockchain through our digital capital markets platform also gives it increased security, direct ownership and expanded liquidity.

Tokenised assets in the form of equity and debt instruments are a rapidly growing investment offering due to the significant benefits they offer to both investors and issuers.

Meaningful points of difference and key metrics

Water Financial identified a significant market opportunity to provide liquidity to retired individuals who own unbonded immovable property. After extensive research and development, the company established a funding model in 2021 tailored to the needs of retirees.

1.

Strong Market Demand:

The rising cost of living, increasing longevity, and a strong preference among retirees to stay in their homes creates a substantial and growing market for our financial solutions.

2.

Innovative Solutions:

Our tailored loan products enable retirees to unlock the value in their homes without the need to sell, providing them with financial flexibility and peace of mind.

3.

Solid Financial Performance

Water Financial has demonstrated strong financial performance, characterised by a growing loan book and low default ratios. Our rigorous underwriting standards and risk assessment processes ensure the quality of our loans and minimize foreclosure risks. As of May 2024, our Loan to Value (LTV) ratio is 8.91%, and we have had no foreclosures to date.

4.

Growth Potential

With a growing population of retirees and increasing awareness of our solutions, Water Financial is well-positioned for significant growth. We continuously refine our products and services to meet the evolving needs of our customers and capture a larger market share.

5.

Experienced Leadership

Our management team brings extensive experience in financial services, real estate, and risk management. Their expertise and strategic vision have been instrumental in driving our success and will continue to guide Water Financial through its next phase of growth.

6.

Tokenised Issuance creates broader access

Our approach combines modern technology with efficient financial solutions, leveraging the promise of the Blockchain to disintermediate traditional financial institutions and enhance returns for retail investors. This innovative approach positions Water Financial at the forefront of the next evolution in finance.

7.

Projected Growth

Our client base is projected to grow significantly over the next decade, from 150 clients in Year 1 to 2,829 clients in Year 10. This growth reflects the increasing demand for our solutions and our ability to scale effectively to meet this demand. The steady rise in the number of clients each year underscores the strong market acceptance and the critical need for our financial products.

What the Water Financial Preference Share offers you:

- General : The 'A' Preference Shares are cumulative, redeemable, floating rate preference shares with no par value. .

-

The Subscription Price of the 'A' preference Share :

R1,000 per 'A' Preference Share.

The minimum investment is 10 Preference Shares, or R10,000.

30,000 'A' preference shares will be on offer. -

Entitlements to Dividends :

Preference Dividends are payable monthly on each Dividend Payment Date.

The Preference Dividends shall rank prior to the dividend rights of the Ordinary Shares.

All the 'A' Preference Shares form part of the same class of share and rank pari passu in respect of all rights.

Subscription opens on 23 August and closes on 30 August on https://app.Mesh.trade. - An ESG investment : ESG investments hold significant potential to outperform other assets, with 53% of institutional investors agreeing that companies with strong ESG track records generate better returns.

- Reduced fees : Mesh offers the most transparent and cost-effective fees in the market.

Why Private Credit

- Recent growth in private credit has been fuelled globally and locally by institutional reticence to lend. Inherent structural inefficiencies within the banking system were exacerbated by the credit crunch and consequent regulatory changes, requiring higher capital provisions plus a focus on matching assets and liabilities, which has led to banks being unwilling to diverge from vanilla or standard offerings.

- This has limited loan book growth and put pressure on banks to focus on shorter term, more expensive loans to fewer borrowers. This in turn has led to slower turnaround times, unpredictable credit decisions and higher pricing.

- On the investor side the search for inflation protected yield is unlikely to dissipate with many moving down the risk curve by investing directly in debt using a variety of access mechanisms like credit funds or non-bank lenders which have grown exponentially internationally since 2008.

- A plus-inflation, highly secured, unleveraged and interest rate correlated return which is in turn uncorrelated with fixed income or equity markets, reduces the average investor’s portfolio volatility and enhances returns which is a golden thread within modern portfolio theory, particularly when the underlying security is the world’s largest.

- In addition it unlocks dormant assets, catalyses the local economy by introducing liquidity and has a major social impact for those retirees.

- General : The A Preference Shares are cumulative, redeemable, floating rate preference shares with no par value. .

-

The Subscription Price of the A preference Share:

R1,000 per A Preference Share.

30,000 A preference shares will be on offer. -

Entitlements to Dividends :

Preference Dividends are payable monthly on each Dividend Payment Date

The Preference Dividends shall rank prior to the dividend rights of the Ordinary Shares.

All the A Preference Shares form part of the same class of share and rank pari passu in respect of all rights.

Subscription opens on 23 August and closes on 30 August on app.Mesh.trade - An ESG investment : ESG investments hold significant potential to outperform other assets, with 53% of institutional investors agreeing that companies with strong ESG track records generate better returns.

- Reduced fees : Mesh offers the most transparent and cost-effective fees in the market.

<span data-metadata=""><span data-buffer="">How it works

- A Preference Share....

- It’s a .

- This is a

- The maturity date

- ... creates an opportunity for you to enhance your portfolio with a yielding investment instrument, while contributing to ...