News & Insights / How markets are reacting to Q1 volatility: The AnBro View

How markets are reacting to Q1 volatility: The AnBro View

In their quarterly note and post tariff announcement update, Chief Investment Officer Craig Antonie shares Λnßro Capital Investments’ analysis of the impact that Q1 volatility has had on the markets, as well as a look forward to what to expect in Q2.

- April 2, 2025

- by Mesh

Its only April but it feels like 2025 is 10 months old already!! Volatility in markets has stepped up considerably over the last few months. From my count we have had over 20 trading days where the S&P500 has moved up or down by greater than 1%, and with so many moving parts at the moment, its likely to remain that way for the time being.

Tariffs are, of course, the topic ‘Du Jour’ and they are causing the most angst at present, primarily because of the uncertainty they are instigating. Markets do not like uncertainty!

UPDATE to Original AnBro Note: April 3, 2025

On April 2, 2025, President Donald Trump announced significant tariffs during an event in the White House Rose Garden, called “Liberation Day.” Key points from the announcement are summarized below:

- Baseline Tariff: Starting April 5, 2025, a 10% tariff applies to most U.S. imports, except for Canada and Mexico under USMCA conditions.

- Reciprocal Tariffs: Higher reciprocal tariffs were announced for numerous countries based on their trade surpluses with the US or their tariffs on American goods. Rates include 54% on China, 20% on the EU, 24% on Japan, 46% on Vietnam, 32% on Taiwan, and 30% on South Africa, effective April 9, 2025.

- Auto Tariffs: A 25% tariff on all foreign-made automobiles is scheduled to start at midnight on April 3, 2025. This measure aims to address trade imbalances and protect the US industrial base, and it includes auto parts in certain situations.

- Exemptions and Specifics: Goods like copper, pharmaceuticals, semiconductors, lumber, gold, energy, and certain minerals are exempt from reciprocal tariffs. Canada and Mexico mostly avoid the 10% tariff under USMCA rules, but non-compliant goods still face 25% duties.

- De Minimis Loophole Closure: President Trump signed an order to eliminate a trade loophole that allowed duty-free shipments of low-value packages (under $800) from China and Hong Kong. This order will take effect on May 2, 2025, with the aim of reducing the inflow of fentanyl.

The announcement was presented as a strategy to reduce the US trade deficit, which was over $1.2 trillion in 2024, and to support American manufacturing by addressing trade practices considered unfair by other nations.

It was stated that these measures aim to prioritise the interests of the United States and could result in economic growth, while also noting possible short-term impacts on consumers.

Global leaders have criticised the tariffs as unfriendly. The European Union, China, and Canada have signalled possible retaliatory measures.

Economists from JPMorgan and Fitch Ratings warn of significant economic fallout, predicting a 2% rise in the Consumer Price Index and increased costs for US households up to $3,400 annually, according to Yale Budget Lab.

They also caution about a heightened risk of global recession if tariffs continue. Markets reacted with stock futures dropping and the US dollar weakening against safe-haven currencies like the yen.

There have been many views expressed about last night’s announcement including some that highlight this as a precursor to some type of roll back if deals can be made. For example, Israel and Vietnam offered to scrap all tariffs on US goods whilst India is considering cutting $23bn worth of tariffs on US imports.

There is still a lot of water to flow under the proverbial ‘bridge’ before we get some finalisation in my view, however we can expect market volatility to persist until more clarity is obtained.

Good luck out there!

The US has the world holding its breath as they move through this process. On top of this, America is undergoing a ‘rightsizing’ of its expenses, putting pressure on NATO / Europe to fund its own defence, trying to broker a peace deal with Ukraine / Russia and still engaging in a spat with China.

Elsewhere, Europe is seeing a bit of a seismic shift with Germany appearing to emerge from its multi-year period of economic stagnation. The largest economy in the region is ready to boost spending and kick start what will hopefully be a sustained period of economic growth (if it can get all political parties to agree, that is). China too is trying to prop up its economy by cutting rates, supporting the property market, encouraging private consumption, and providing fiscal stimulus.

From a South African perspective, participants are still evaluating the potential political and economic fallout from final budget vote which is causing worry and frustration.

It has been a busy quarter…

Speaking to companies, we are finding most are opting to be a bit more cautious as they wait for things to iron themselves out. The impact of Tariffs is the most critical issue and as a result they are adopting a ‘wait and see’ approach. The problem however is this element of ‘waiting’ is starting to weigh on sentiment, and potentially on earnings growth and momentum this year. With job growth slowing alongside some companies downsizing, there are growing concerns around employment, whilst at the same time the debate is still raging on the impact tariffs will have on inflation. Recession and Stagflation are once again becoming a point of discussion.

It’s hard to get into a debate around all these things right now because although there are many views and opinions out there of the likely impact of US tariffs, the war in Europe, inflation, interest rates, bond yields and earnings growth, the truth is we just don’t know how it will pan out.

Markets in the first three months of 2025 have literally been all over the place, starting the year on the front foot we rose to record highs. In the US, this was then followed by a 10% decline (a correction) and now markets are considering their options in light of the US administrations Tariffs announced on the 2nd of April.

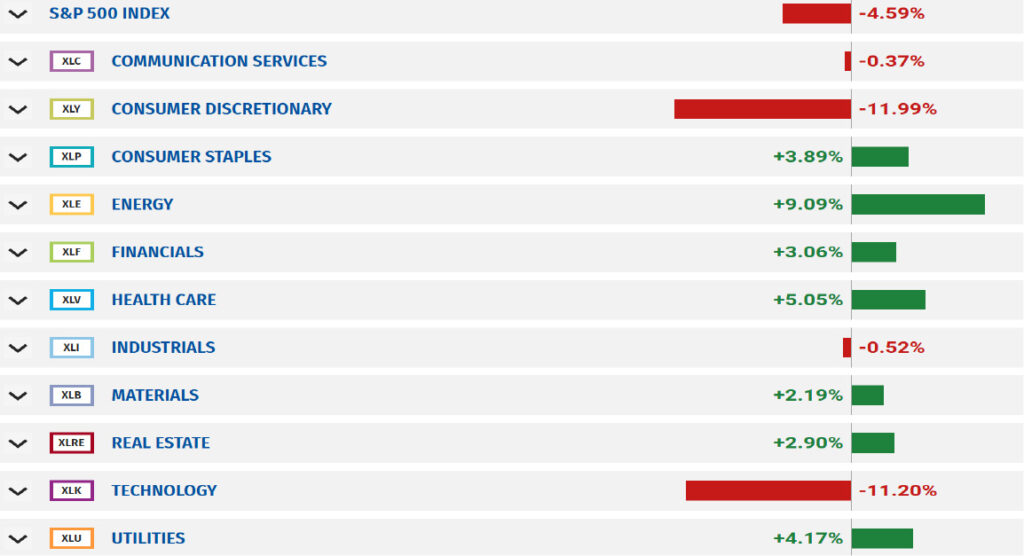

YTD the S&P 500 is down 4.59%. From its record high, its closer to 9%. The Nasdaq is down by 10.42% YTD and just over 14% from its record high, but as usual there is a divergence of performance. Looking below we can see that ‘higher risk/growthier’ sectors like Consumer Discretionary and Tech are down quite a bit. Defensive sectors like Healthcare, Utilities and Consumer Staples are having a strong year, whilst Energy is shooting the lights out.

March in particular was a bad month and the second half of it especially so as tariff deadlines loomed large. Many investors decided to opt out or rotate to more defensive positioning. The only sector up for March was energy.

LOOKING AHEAD

Looking to the second quarter, clarity around the tariff issue is likely the most critical issue. It is important so that companies can change, adapt, and get on with business. The ‘weight’ of that lifting off markets will allow us to focus on fundamentals again. However, as we know from President Trump’s first term, late night ‘tweets’ and occasional rants are quite common so it’s best to accept that this will also be a feature of his second term and the next few years as a result. Will there be a resolution in Europe? Will the Tariff impact be ‘moot’ at the end of it all? Will inflation rise as many fear? Can we avoid Recession? Will rates be cut further? Let’s see how this plays out.

AnBro Portfolios

Conservative/Balanced

The AnBro Dynamic Compound portfolio (JSE: ANCOMP), with its current dividend yield of 3.38% in USD, ended the quarter and YTD up 3.68%% in ZAR and 6.36% in USD. The portfolio performed very well during the first quarter of 2025. Market volatility and the risk off mood played into the hands of our holdings here. The overweight positions in global Utilities, Real Estate and Insurance added significant Alpha and helped drive a strong return. Many companies update their annual dividends at the beginning of the year and as a result we saw some very impressive increases in our cash flow. Some examples of exemplary dividend increases came from the following companies:

Company | 5% Div Growth |

|---|---|

The Coca-Cola Company | 5.16% |

Avlva Plc | 6.73% |

Abbott Labs | 7.30% |

E.ON | 7.80% |

Next Era Energy | 10.00% |

Equinix | 10.00% |

The London Stock Exchange | 12.23% |

MSCI | 12.50% |

Munich Re | 33.35% |

Beazley Plc | 76.06% |

As a reminder, this portfolio is positioned in such a way that lower interest rates and/or a risk off market will provide support to the underlying companies here. We view it as the more conservative of the three strategies we run.

AnComp*

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Utilities | E.ON | Broadcom | Information Tech |

Healthcare | United Health | SAP | Information Tech |

Insurance | Prudential Plc | Equinix | Property |

Infrastructure | Clearway Energy | Prologis | Property |

Property | Crown Castle | Compass Group | Consumer Discretionary |

*YTD performance |

High Quality/Diversified

The AnBro World’s Biggest Brands Portfolio (JSE: BRNDZ) fell by 6.88% in ZAR and 4.44% in USD during the first quarter and YTD 2025. Some interesting observations here is that the bottom five performers all came from the consumer discretionary sector and that even Luxury behemoth Louis Vuitton was under pressure. On the other side of the scorecard BYD is soaring as the Chinese EV maker overtakes Tesla in sales for the first time. This portfolio is reweighted annually at the end of the first quarter, and we cannot wait to see how consumer behaviour and brand consumption may have changed and evolved over the last year. This is considered a high quality, diversified, global portfolio by the team at AnBro. It sits in the middle of the risk spectrum of the strategies we run.

BRNDZ*

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Consumer Discretionary | BYD Co LTD | Kering | Consumer Discretionary |

Healthcare | United Health | Nike | Consumer Discretionary |

Energy | Exxon Mobil | Lululemon | Consumer Discretionary |

Financials | HDFC Bank | LVMH | Consumer Discretionary |

Consumer Discretionary | PDD Holdings | Starbucks | Consumer Discretionary |

*YTD performance |

High Growth/Blue Sky

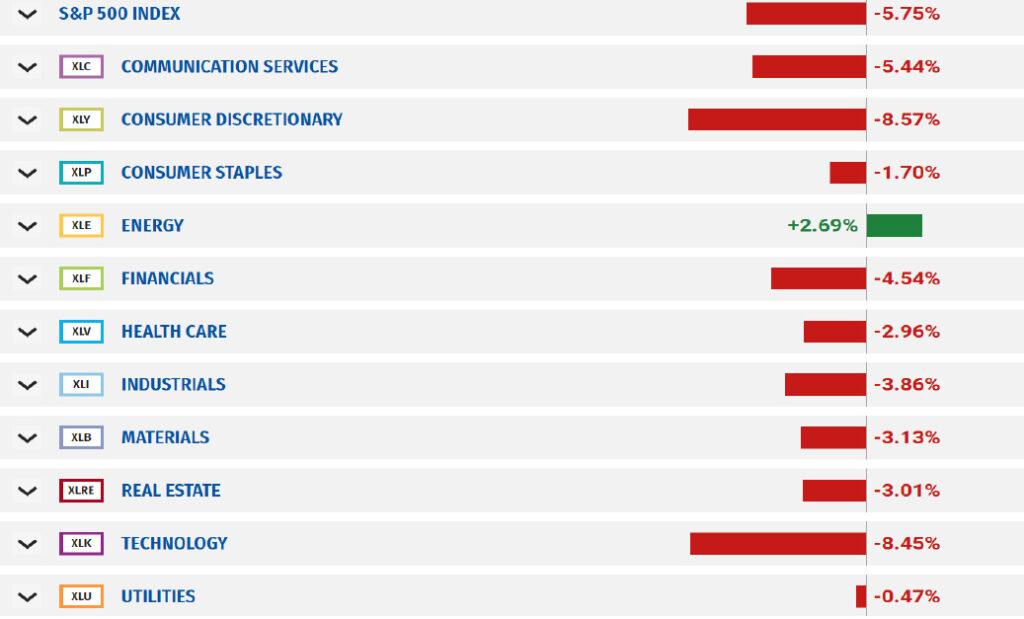

The AnBro Unicorn Growth portfolio experienced a decline in the first quarter and YTD 2025, decreasing by 12.97% in ZAR and 10.74% in USD. The growth sectors, specifically Technology (-11.2%) and Consumer Discretionary (-11.99%), faced significant selling pressure over the past three months due to concerns about the impact of tariffs on both the companies involved and the broader economy. The AI premium previously factored into companies such as Nvidia has started to diminish, and the “Magnificent 7,” which had attracted substantial investor inflows over the last two years, has fallen 15.73% so far this year. Consequently, there has been a notable shift in investor positioning towards more traditional safe-haven investments.

The AnBro team see this portfolio as the one that offers the highest growth and blue-sky potential. It suits long-term investors looking to buy a piece of companies that offer massive long-term upside. It is by far the most ‘exciting’ portfolio we run and certainly the most volatile too. It earns its place in a diversified portfolio via its potential for life altering returns.

*PLEASE NOTE THE PORTFOLIO TICKER ON THE JSE HAS CHANGED FOR UNICORN FROM UABCPA TO UNICRN*

Unicorn*

Sector | Top 5 | Bottom 5 | Sector |

|---|---|---|---|

Consumer Staple | Celsius Holdings | Unity Software | Information Tech |

Insurance | Kinsale Capital | HubSpot | Information Tech |

Information Tech | Cellebrite | Kyndryl Holdings | Information Tech |

Healthcare | Veeva Systems | ServiceNow | Information Tech |

Information Tech | Cadence Design Syst | The Trade Desk | Communication Services |

*YTD performance |

So, as we forge ahead in 2025 and digest all the ‘moving parts’, we at AnBro just stick to our process and look for opportunity in all the noise out there. Just like other periods of uncertainty in our recent and long forgotten past, one truth exists, the world, companies and markets ultimately find a way through it.

As a parting note, I’d ask you to keep an eye on your inbox, in the next few weeks AnBro will be announcing the launch of its CORE portfolio to the market. With better risk adjusted returns than the S&P 500, we are incredibly excited to introduce it as another interesting and differentiated investment option from our team.

As always, thank you for all your ongoing support!

All the best,

Craig Antonie and the AnBro team.

Tags

AI AltFi Asset Maturity Blockchain Capital Markets Capital Markets Capital Markets of the Future Investing Mesh Open to all Smart Assets Capital Markets of the Future Commodity Markets Crypto Markets Decentralisation DeFi DieMos ETN Financial Markets FinTech Floating Rate Bond FSP FTX Global Markets Gold Investing Investment Mesh Open to all Regulation Secondary Market Smart Assets Stellar Tokenisation TradFi Webinar

- Capital Markets, Capital Markets of the Future, Global Markets, Investing

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515