News & Insights / Gold: A Prime Investment Opportunity in 2025

Gold: A Prime Investment Opportunity in 2025

Gold continues to stand out as an attractive investment option in 2025.

- February 26, 2025

- by Mesh

By Rob Mackay, Investor Manager Lead at Mesh.trade

Gold has demonstrated significant growth over the past year, with its upward momentum supported by geopolitical uncertainties, economic volatility, and strong demand for safe-haven assets.

In early 2024, prices were around $1 800 per ounce, but by February 2025, they had climbed nearly 63% to $2 915 per ounce. Goldman Sachs analysts have suggested that gold could exceed $3 000 per troy ounce by the end of 2025; while Deutsche Bank is similarly bullish, believing that gold will go no lower than $2 450, and could go as high as $3 050. Key drivers behind these predictions include sustained central bank demand and macroeconomic uncertainties.

According to the World Gold Council, global central bank demand for gold nearly increased from 655 tons in 2019 to 1 030 tons in 2023. Meanwhile, investor interest in gold-backed exchange-traded funds (ETFs) has also increased. Led by gold’s strong returns, gold ETFs saw record inflows in 2020, hitting $47.9 billion.

In January 2025, global physically-backed gold ETFs recorded net inflows of $3 billion, surpassing the inflows of the previous quarter. South Africa, in particular, experienced its largest-ever monthly gold ETF inflow, driven by falling yields and expectations of domestic rate cuts.

Although only reflecting flows to 2020, the graphic below (from Visual Capitalist) is informative, especially in light of the growth in demand for gold from 2020 to today:

Tokenised Gold: A Modern Investment Approach

In South Africa, tokenised gold investments are changing how investors access the gold market. These digital assets represent direct ownership of physical gold, while offering benefits such as greater liquidity, fractional ownership, and seamless transfers. As the domestic fintech sector expands, tokenised gold provides a flexible and accessible way to invest in gold.

Mesh, in collaboration with TroyGold, is bringing to market a tokenised 1oz bullion Krugerrand that can be bought in fractions, requiring a minimum investment of just R50. This innovative approach allows more investors to participate in the gold market with lower barriers to entry.

The Investment Case for Gold

Even investors with neutral or conservative outlooks can benefit from gold’s role as a diversification tool. By adding gold to an investment strategy, investors can reduce risk and stabilise portfolio volatility, particularly during uncertain or inflationary periods. Historically, gold has served as a hedge against currency devaluation and market instability, making it an essential asset in times of economic uncertainty.

Gold has been a vital medium of exchange for thousands of years, and has consistently delivered solid long-term gains.

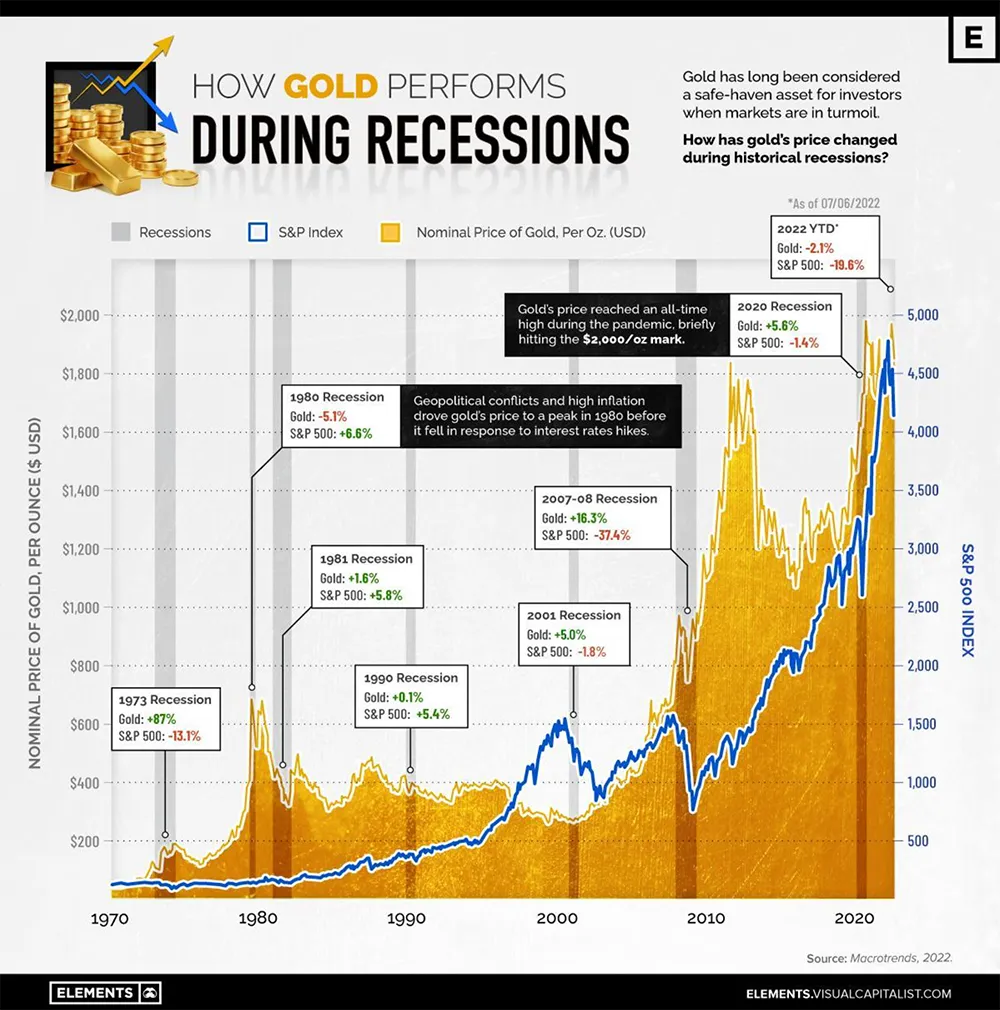

A brief history lesson is useful here, as one looks at how the gold price has changed during historical recessions. During the US recession of 1973, while the S&P 500 dropped by 13.1%, the gold price soared by 87%. During the 2001 recession, the S&P 500 lost 1.8% while the gold price increased by 5%. Then in 2020, gold’s price reached an all-time high during the pandemic as it briefly hit the $2 000/oz mark. While the gold price increased by 5.6%, the S&P 500 dipped by 1.4%.

This is nicely illustrated by the graphic below:

Time and again, gold has served as a safe-haven asset for investors when markets were in turmoil.

Investing in Gold in 2025

With gold prices reaching new heights and investment demand remaining strong, gold presents a compelling opportunity in 2025. Investors have multiple ways to gain exposure to this valuable asset, including traditional bullion, gold ETFs, and innovative tokenised gold.

That’s what makes the TroyGold Coin (TGLD) token such an exciting opportunity. Each token, available exclusively to registered Mesh.trade users, represents immutable ownership of a physical 1oz Krugerrand coin, stored at the internationally recognised, secure gold storage vault facility Brink’s.

It offers a rare opportunity for retail investors, coming at a special discount of up to 3% to the current market price.

What’s more, investors can buy any fraction of a Krugerrand coin, with a minimum required investment of just R50. Typically, South Africans may only purchase 1oz, ½oz and, in some cases, ¼ oz and 1/10th oz Krugerrand coins from various distributors. The R50 minimum investment for the TroyGold Coin (TGLD) token removes those traditional barriers to entry, and makes owning physical gold a real option for all investors. It means that investors accumulate their fractional investments over time to the equivalent weight of 1oz, they can them redeem their tokens and arrange with TroyGold for secure delivery of their Krugerrand coins to their homes, if they so desire.

Whether you’re seeking portfolio diversification or hedging against economic uncertainty, the tokenised bullion Krugerrand in fractionalised increments offered by Mesh is a good starting point in building a gold position.

• Invest in the TroyGold Coin (TGLD) token.

Tags

AI AltFi Blockchain Capital Markets Capital Markets Capital Markets of the Future Investing Mesh Open to all Smart Assets Capital Markets of the Future Commodity Markets Crypto Markets DeFi DeFi Mesh Cryptomarkets DieMos Digital Bond ETN Financial Markets FinTech Floating Rate Bond FSP Global Markets Gold Investing Investment Mesh Metal Markets Open to all Regulation Secondary Market Silver Smart Assets Tokenisation TradFi Webinar

- Blockchain, Capital Markets of the Future, Investing, Mesh, Open to all

Want to stay in the know on upcoming events and seminars?

Newsletter Sign Up

For more press information, please contact:

Connie Bloem, Product owner of Mesh:

hello@meshtrade.co / +1 604 671 4515