Asset Overview

The Λnßro World’s Biggest BRNDZ AMC is a USD-based capital growth portfolio that aims to deliver long-term capital growth by investing in globally recognised companies with strong brand value, specifically built to outperform the S&P500.

This portfolio caters to investors looking for consistency and growth over time. By focusing on companies with robust cash flows and demonstrated brand loyalty, the portfolio seeks to provide steady returns while managing short-term market fluctuations, making it an ideal core holding for those with a minimum five-year investment horizon.

Investment Strategy:

The Λnßro World’s Biggest BRNDZ AMC follows a unique approach, focusing on companies that have built strong brand value over decades.

The portfolio strategy is built on these key principles:

- Global Household Names: The portfolio invests in brands that are part of our daily lives – companies that have earned consumer trust and loyalty. These brands are deeply embedded in our everyday routines, from the products in our homes to the cars on our streets.

- Strong Brand Valuation: Using a proprietary brand valuation model, the portfolio selects the world’s top 100 brands based on brand value, not just market capitalisation. This emphasis on brand strength helps identify companies with strong consumer appeal, robust cash flows, and a proven ability to thrive through economic cycles.

- Resilience in Volatile Markets: This portfolio was created in response to market volatility and investor demand for a more stable growth option. It provides exposure to businesses that are easier to understand and more tangible, reducing anxiety during market downturns. The portfolio’s 100 blue-chip companies have consistently demonstrated their ability to navigate economic challenges while maintaining strong financial health.

Why Invest?

By investing in the Λnßro World’s Biggest BRNDZ AMC, you gain access to a curated selection of companies with a track record of success.

The portfolio offers:

Stable, Recurring Cash Flows: These businesses generate reliable income streams, enabling them to reinvest in growth, pay dividends, and maintain strong balance sheets.

Lower Volatility, Consistent Growth: While not as aggressive as Λnßro’s high-growth portfolios, this portfolio offers a smoother ride for investors by focusing on companies that have withstood the test of time. It aims to deliver competitive returns with less of the dramatic swings seen in more speculative investments.

Strategic Access Through Mesh: Purchase the rights to this listed AMC note on Mesh to include these well-known, globally recognised brands in your investment strategy, offering you a solid foundation for your portfolio.

Considerations for Investors

This portfolio is ideal for those seeking a core, long-term holding. It is well-suited to conservative investors who seek stability while still aiming for steady growth.

The annual rebalancing process ensures the portfolio remains aligned with market trends and brand performance, adapting as new leaders emerge in the global marketplace.

Invest in the Λnßro World’s Biggest BRNDZ AMC today and align your portfolio with companies that are not just well-known, but truly enduring.

What is an AMC?:

An AMC (Actively Managed Certificate) is a structured product designed by asset managers to implement and actively manage a portfolio of assets, such as stocks, bonds, or other securities.

Unlike traditional funds, AMCs provide greater flexibility and transparency, enabling investors to benefit from a customised investment strategy tailored to specific goals and risk profiles.

AMCs are ideal for those investors seeking targeted exposure to specific sectors or investment themes, offering an innovative way to access a diversified portfolio through a single, convenient product. Each Λnßro fund is, therefore, tailored to provide investors with specific, diversified portfolio opportunities to meet their individual investment objectives.

For more information on this portfolio and how it works, click the button below to view our FAQ section.

Portfolio Specifics

Investment Focus:

Global Equities

Class Launch Date:

20 Sep 2023

Investment Term

Suggested

or longer

(long-term)

Benchmark:

S&P500

Risk Rating:

Moderate to High

ISIN Number :

ZAE000326641

JSE Share Code:

BRNDZ

Asset FAQ's

The Λnßro World’s Biggest BRNDZ AMC is a USD-based capital growth portfolio that aims to outperform the S&P 500 by investing in globally recognised companies with proven success and longevity.

The objective is to outperform the S&P 500 while providing a straightforward investment process, allowing investors to manage their portfolios effectively over the long term.

It is tailored for long-term investors who are willing to navigate short-term market fluctuations due to large exposure to global equities in pursuit of sustained growth.

The portfolio focuses on household names and globally recognised brands that have consistently demonstrated success and had an enduring impact on our daily lives.

The suggested investment term is 5 years or longer, allowing for adequate time to build wealth with these enduring global companies.

While the portfolio is designed for long-term growth, investors should be aware that it may still experience short-term market fluctuations typical of equity investments.

The JSE Share Code is BRNDZ.

Follow this link to view the asset on the Mesh marketplace.

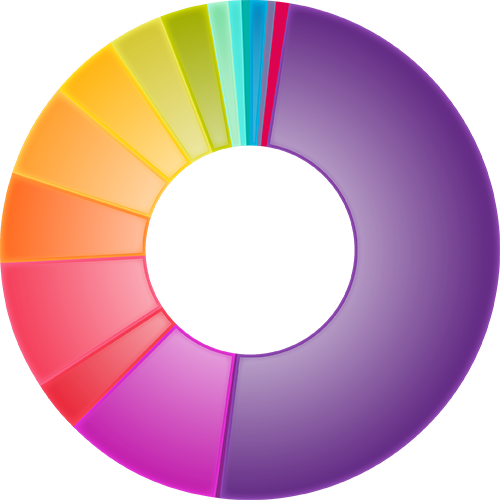

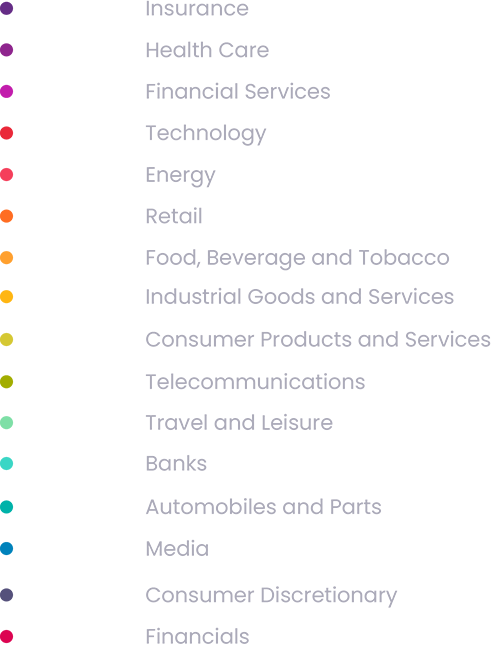

Equities Weighted Sector

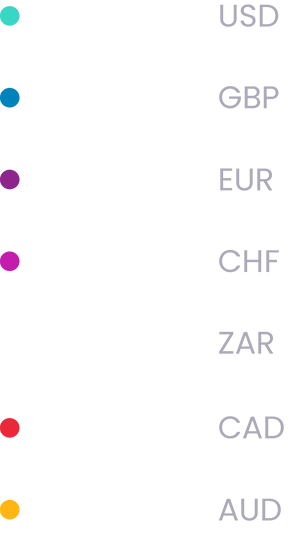

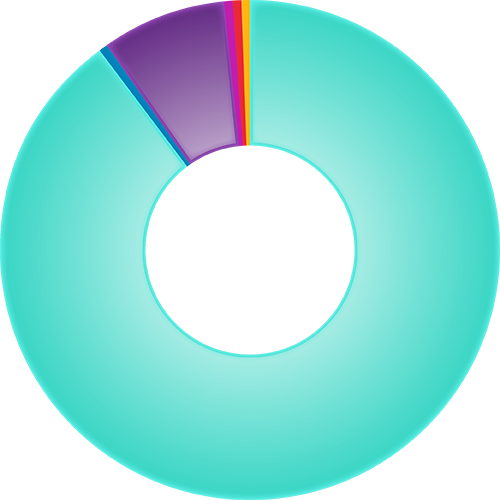

Equities Weighted Currency