Asset Overview

The Λnßro Dynamic Compound AMC is designed for long-term institutional and retail investors looking to achieve compound growth through the steady reinvestment of regular dividend payments.

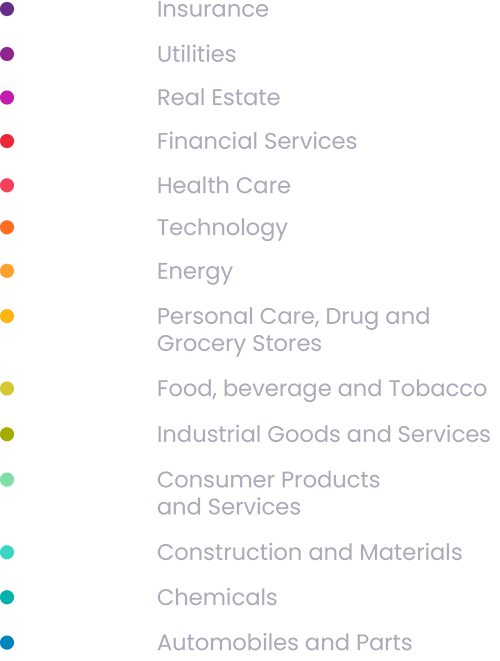

This medium-risk portfolio focuses on high-quality, high-yielding companies such as Insurance, REITs, Utilities, FMCG, and Infrastructure assets.

By reinvesting the regular dividend flow from these firms, the portfolio aims to accelerate compounding returns, delivering results that outpace inflation over time.

Investment Strategy:

The Λnßro Dynamic Compound AMC is designed for long-term institutional and retail investors looking to achieve compound growth through the steady reinvestment of regular dividend payments.

This medium-risk portfolio focuses on high-quality, high-yielding companies such as REITs, Utilities, and Infrastructure assets. By reinvesting the regular dividend flow from these firms, the portfolio aims to accelerate compounding returns, delivering results that outpace inflation over time.

Overarching Investment Objective:

The Λnßro Dynamic Compound Portfolio AMC is dedicated to transparency through clear, predictable outcomes, with the objective of consistently outperforming inflation over the long term.

The fund is built on this key principle:

Stability and income generation. It draws from the legacy of solid, blue-chip companies that continue to deliver a consistent flow of dividends, with a focus on reliable, tangible assets that underpin modern life – from data centres and fibre optics providers to renewable energy firms.

Why Invest?

Reliable Dividend Income: The portfolio targets companies that can maintain consistent cash flows, offering dividends that are automatically reinvested to fuel further growth.

Diverse Exposure: Gain access to a diversified mix of infrastructure, technology, and consumption trends, spanning key areas such as clean energy, data infrastructure, and utilities.

Built for Long-Term Stability: While dynamic compounding might be considered a “boring but reliable” approach, it is precisely this steady nature that appeals to those seeking to build wealth sustainably. It’s a strategy that works like a snowball – gaining momentum and accelerating over time.

Strategic Access Through Mesh:

Investing in this AMC through Mesh offers a strategic opportunity for those who value both predictability and growth.

It’s especially suitable for investors who prefer a hands-off approach, knowing their investments are continuously growing through the power of compounding. With a solid focus on companies with robust balance sheets and proven resilience, this portfolio ensures that your investments are not just protected but positioned to thrive through economic cycles.

By focusing on compounded returns through dividends, this fund provides a straightforward investment strategy for those seeking sustainable, long-term growth.

What is an AMC?:

An AMC (Actively Managed Certificate) is a structured product designed by asset managers to implement and actively manage a portfolio of assets, such as stocks, bonds, or other securities.

Unlike traditional funds, AMCs provide greater flexibility and transparency, enabling investors to benefit from a customised investment strategy tailored to specific goals and risk profiles.

AMCs are ideal for those investors seeking targeted exposure to specific sectors or investment themes, offering an innovative way to access a diversified portfolio through a single, convenient product. Each Λnßro fund is, therefore, tailored to provide investors with specific, diversified portfolio opportunities to meet their individual investment objectives.

For more information on this portfolio and how it works, click the button below to view our FAQ section.

Portfolio Specifics

Investment Focus:

High Value, long-term investment compounded dividend returns.

Class Launch Date:

29 Nov 2022

Investment Term

Suggested

or longer (long-term)

Benchmark:

Composite Benchmark*

Risk Rating:

Moderate

ISIN Number :

JSE Share Code:

ANCOMP

Asset FAQ's

The AnBro Dynamic Compound AMC is a portfolio that invests in companies which offer high and growing dividend income, with the intention of reinvesting the dividends to allow for accelerated compounding.

The portfolio aims to achieve transparency through clear, predictable outcomes while consistently outperforming inflation over the long term, by focusing on compounded returns through dividends.

It is suitable for both institutional and retail investors looking for a straightforward investment strategy that emphasises long-term growth and robust cash flow through dividends.

The portfolio focuses on blue-chip assets, including but not limited to REITs, utilities, preference shares, and infrastructure assets.

The suggested investment term is 5 years or longer, allowing time for the benefits of compounding to be realised.

The risk rating for the Λnßro Dynamic Compound AMC is classified as moderate, reflecting a balanced approach to risk and return.

The JSE Share Code is ANCOMP.

Follow this link to view the asset on the Mesh marketplace.

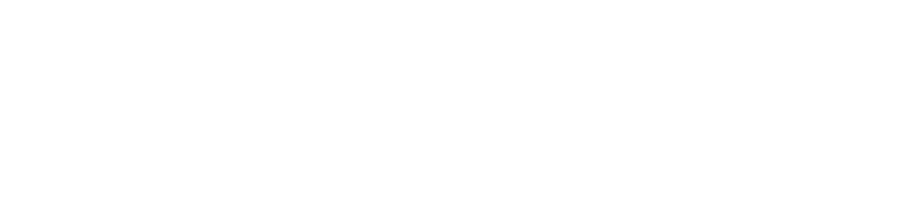

Equities Weighted Sector

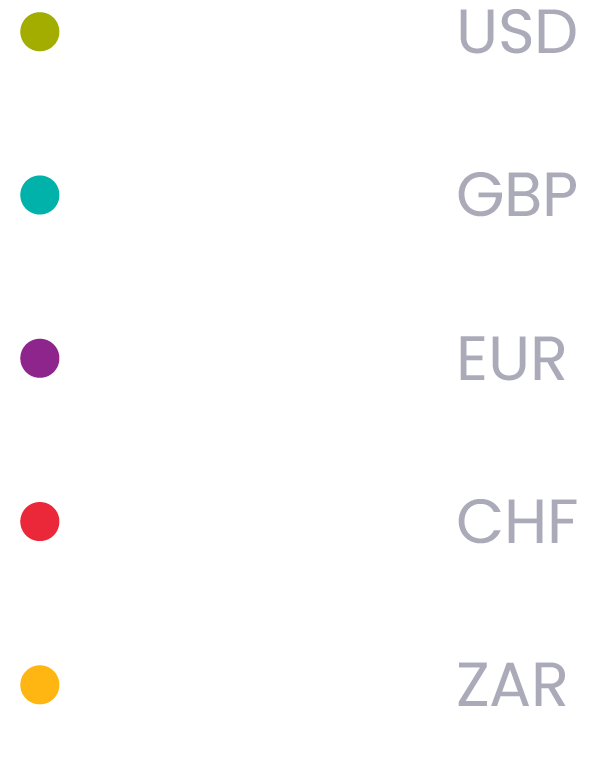

Equities Weighted Currency